Draining the Oil Stocks

April 23, 2021

Will falling oil inventories drive up tanker rates?

When Covid-19 started to spread around the world in the early months of 2020, a conflict erupted between Saudi Arabia and Russia. How should oil producers respond to the threat of falling demand? When Russia resisted the cut in production by OPEC+ that was advocated by Saudi Arabia, the kingdom retaliated. Saudi Arabia cut its selling prices and opened the spigots. Saudi Arabia boosted exports by more than 2 million barrels per day, just as global lockdowns due to Covid started to spread around the world.

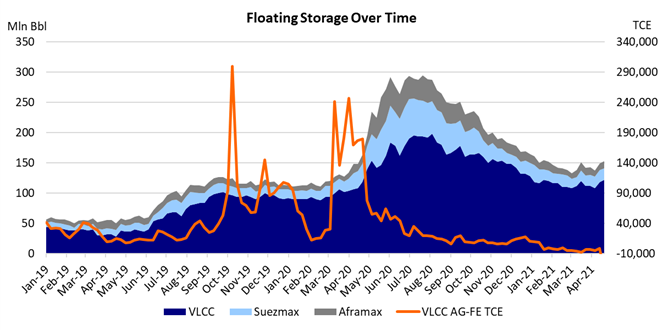

The result was a dramatic oversupply of crude oil, leading to soaring oil stocks, both on-land and at-sea. By May 2020, at the peak of the storage boom, the IEA estimated that global oil inventories had increased by 1.4 billion barrels, of which about 20% was stored on tankers. OPEC quickly changed their plans and in May 2020 they cut production by almost 10 million barrels per day. Only recently has OPEC decided to start bringing production back. Since the cutbacks in 2020 (both OPEC and non-OPEC producers significantly reduced output), global crude oil inventories have come down significantly, both onshore and offshore.

To read the full article, please fill out the form.