- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LNG in World Markets Featured Article

US LNG Contract Prices Rise on Higher Costs, EPC Price Refreshes

This current feature was extracted from the latest edition of Poten’s LNG in World Markets, published on March 2025

Most US liquefaction fees are being discussed at $2.65-$2.95/MMBtu as EPC cost escalations show no sign of abating.

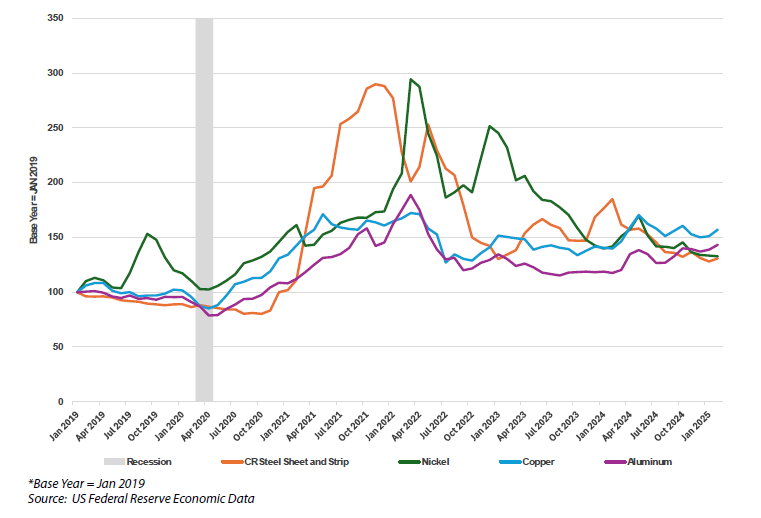

Higher raw material prices, which are seeing further escalation because of tariffs, coupled with rising labor and financing costs are having a pronounced impact on US LNG liquefaction project implementation. The cost increases make it challenging for developers to keep engineering, procurement and construction (EPC) contracts valid as they try to move ahead with their LNG export projects.

Shorter price validity windows and a higher reimbursable component for projects without lump sum turnkey (LSTK) contracts are major concerns. US LNG project sponsors are now left with little choice but to raise their offer prices and renegotiate existing sales and purchase agreements (SPAs) or run the risk of being deemed to be loss-making and unfinanceable by banks.

While the Trump administration has improved the regulatory landscape (see p.5), its harsh import tariff stance has consequences for US LNG developers, as it has heaped on to the higher costs as they already battle to keep a lid on climbing capex. Under a March 12 order, the administration imposed 25% tariffs on all imports of steel and aluminum. The action was aimed at bolstering domestic production of those metals but comes at the expense of large projects, like LNG export facilities, which are heavy users of these commodities. The tariffs have already started to exert further upward pressure on steel and aluminum prices (see Chart).

As a result of the cost increases, most US LNG project sponsors are now offering $2.65-$2.95/MMBtu, with a handful still at $2.45/MMBtu for supply starting in 2029. This compares to low-to-mid $2s/MMBtu offered by US projects in 2022. Asian buyers in negotiations with US LNG projects are aware that levels below the market average are almost certain to be renegotiated, especially for projects with more distant development timelines.

US LNG project sponsors that have not signed EPC contracts or bought their steel or aluminum will face the biggest price exposure. Poten understands some US LNG projects have even refused to offer a firm liquefaction fee in the market, citing uncertainty over raw material costs, particularly for steel and aluminum. And even for LNG projects that have signed LSTK contracts, there is a prospect of price hikes. Bid validity has shortened to six months and even with a full EPC wrap, some costs will be at floating rates.

EPC contractors are quoting significantly higher LSTK contracts, which makes some projects unviable. Some developers have little choice but to adopt a fixed cost plus a reimbursable component to bring their EPC cost down. But this means that a part of the EPC risk is now borne by the LNG project owners.

Labor costs have also gone up by 30-40% since 2022 and could climb even further on Trump’s anti-immigration policy and deportation threats. The pool of experienced workers in the US is also expected to decrease.

Financing costs for US LNG projects also remain high because of stubbornly elevated base rates. The1-month Secured Overnight Financing Rate (SOFR) – on to which bank margins are applied – is at 4.33% which is down from its peak of 5.3% in 2024 but still much higher than the levels of less than 0.05% seen in 2022 which were a response to economic collapse as a result of the pandemic. Bank margins, however, are expected to remain stable. US projects securing financing in 2023 saw margins of around 2-2.25% – similar levels could be achieved this year, although there could be a small uptick if the number of projects seeking funding starts to test bank capacity. If they do not see much change, this would give all-in costs of around 6.3-6.6%, although margins are discretionary and influenced by the quality of off takers, EPC contractors, developer experience and other factors.

VG seeks price hikes for CP2 SPAs

Venture Global is said to be seeking price hikes for its existing CP2 LNG off takers amid rising EPC and inflation costs. Most of its CP2 LNG SPAs are understood to be signed at a low-$2s/MMBtu liquefaction fee and Venture Global is seeking to raise the level to $2.80/MMBtu. It remains to be seen whether existing CP2 off takers will accept the proposed price increase. Some of the off takers have a 1 MMt/yplus 1 MMt/y deal with Venture Global where they lift from Plaquemines LNG and CP2 LNG while some have bridging volumes from Plaquemines LNG for CP2 LNG contracts.

Separately, Venture Global is offering supply to new buyers from CP2 LNG at 115% of Henry Hub plus $2.85 for 20 years. Venture Global has also started to raise financing for CP2 LNG and aims to take a final investment decision (FID) for the first phase of the 14.4-MMt/y project by this year.

Phase 1 was more than 75% sold out, although it is unclear if there will be changes amid the ongoing price talks. CP2 LNG holds 9.3 MMt/y of 20-year SPAs with customers New Fortress Energy, ExxonMobil, Chevron, Inpex, China Gas, Jera, SEFE and EnBW. The project also signed a 2-MMt/y HOA with Ukrainian buyer DTEK for Henry Hub-linked volumes with a liquefaction fee in the mid-$2/MMBtu range.

Metals Indices*

Next Decade negotiating EPC price refresh

Next Decade signed an EPC contract with Bechtel for its Rio Grande LNG Train 4 project in August 2024 but was delayed by regulatory and legal setbacks. However, pricing for the Train 4 EPC contract was only valid through Dec. 31, 2024. Next Decade is negotiating a pricing refresh that is expected to be completed later this year, followed by an FID for the project. In the meantime, Next Decade is also said to be marketing volumes for Rio Grande LNG Train 5 at $2.65-$2.75/MMBtu, which is in line with current market pricing.

Rio Grande LNG is 53% sold out for Train 4 after signing supply agreements with Middle Eastern portfolio players ADNOC and Aramco. French oil major TotalEnergies is expected to take both equity and offtake from the Texas project.

Elsewhere, Sempra is understood to be sold out for the 13.5-MMt/y Port Arthur Phase 2 expansion and is also targeting FID this year. However, it is awaiting a non-FTA permit and faces a legal challenge to its air pollution permit. The project continues to litigate the air pollution issue before the US Court of Appeals for the Fifth Circuit, which will apply the standard adopted by the Supreme Court of Texas. In a Feb. 14, 2025 opinion, the Texas Supreme Court interpreted the issue more favorably to the project. It now goes back to Fifth Circuit for final decision. It is now focused on signing SPAs with two large off takers, ConocoPhillips and Saudi Aramco. Aramco signed an HOA for 5 MMt/y and a 25% stake in June last year, while ConocoPhillips has the right to buy up to 5MMt/y, as part of its SPA signed with Sempra for Port Arthur Phase 1.

Energy Transfer to sign more HOAs

Energy Transfer is expected to sign two more HOAs next month. One of the buyers is understood to be a German firm, while the other buyer may be a Mideast-backed player. Energy Transfer was also in price renegotiations with its existing off takers. A few of its SPAs were signed at sub-$2/MMBtu liquefaction fee plus 115% of Henry Hub.

Separately, a Southeast Asian player may sign a HOA with a US project over the next few months.

Woodside Energy delayed its FID for its Louisiana LNG project from the first quarter to the second quarter of this year, as negotiations with potential equity buyers continue. The Australian oil and natural gas giant is seeking to sell up to a 30% stake in the US project to help cover cost exposure. Potential buyers that were in talks include Williams, Saudi Aramco-backed Mid Ocean Energy and Japanese buyers, Jera and Tokyo Gas.

Woodside plans to develop three trains totaling 16 MMt/y. It wants to keep 8 MMt/y in its supply portfolio and sell the remaining 8 MMt/y, potentially including volumes from investors that would prefer to offload the offtake that comes with their equity investment. Woodside is marketing at $2.95-$3/MMBtu for long-term supply and is open to selling for 5, 7or 10-year deals. Woodside is unlikely to require debt financing, but equity investors will require the company to market its equity offtake at a certain price level to meet the expected internal rate of return.

Buyers still mulling US supply

Despite rising US liquefaction fees, portfolio players including ConocoPhillips, Chevron, Japanese trading houses and key buyers like Jera and Tokyo Gas are still considering US LNG supply. Japanese buyers have been pushed by the government’s Ministry of Economy and Trade and Industry (METI) to secure more US LNG since last year and buying has gained momentum in this year’s negotiations. This is partially a way to appease the Trump administration and reduce Japan’s trade deficit with the US.

A deal is expected to be reached by Japanese buyers later this year. Several Japanese buyers and trading houses continue to value the US as an LNG supply source, as it is free-on-board (FOB) which means that the destination is flexible.

Many had previously looked at investing in US liquefaction projects, but Poten understands that attention has shifted to upstream gas acquisitions instead. This is to manage the prospect of rising Henry Hub gas prices in the near to mid-term as a “natural hedge”. If Henry Hub gas prices rise, buyers will benefit from their upstream purchases. Alternatively, if Henry Hub prices trend lower, buyers benefit from a lower LNG price.

There are also limited supply options globally. QatarEnergy continues to impose destination restrictions while Australia is facing limited LNG expansion opportunities. Cost is also a concern in Australia. Russia as a supply source remains challenging even if sanctions are lifted. This is due to concerns that the removal of restrictive measures may only be temporary, and pipeline take or pay contracts may or may not be successfully renegotiated. To reconsider Russian supply potential, customers would need to see the situation stabilize over a prolonged period.

Other proposed liquefaction projects in Africa and Latin America face significant political, commercial and financial risks. Despite the political disruption, such as the implementation of trade tariffs, and higher costs, the US is still seen as one of the most reliable supply sources of LNG.

Subscribe to Poten’s LNG in World Markets

Industry participants rely on Poten’s LNG in World Markets business intelligence service for the best information to drive business success. To activate your subscription or learn more, connect with us today: [email protected]

Get to Know Poten’s LNG Business Intelligence Services

Actionable short term market intelligence

- Monthly country-level forecasts

- Global arbitrage analysis

- Detailed data on future trade flows

Analysis of LNG finance across the value chain

- Annual ranking of LNG lenders

- Detailed analysis of project lending

- Intelligence on project finance structure

- Insight on lending to the shipping sector

A 10-year price, supply and demand forecast

- 10-year projections

- Bottom-up demand forecasts

- LNG imports and exports

- Special focus on shipping

Insight on LNG markets, projects and the industry

- Commercial and technical details of global projects across the value chain

- Detailed coverage of spot markets with data and analysis on market fundamentals, price levels and trade flows

- Shipping activity and technology developments