- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LPG Market Outlook Featured Article

Higher Prices to Lower Near-Term Chinese Demand

This current feature was extracted from the latest edition of Poten’s LPG Market Outlook, a monthly service published on April 12, 2024.

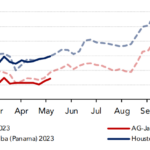

Chinese imports rebounded in March 2024 from February lows, but bearish sentiment shrouds the future of LPG demand in the near-term. Not only are petrochemical players continuing to struggle with weak margins, but US prices have risen in recent weeks due to higher oil prices. Oil prices are unlikely to fall in the near term and US prices are likely to remain elevated as a result, keeping demand growth to a minimum..

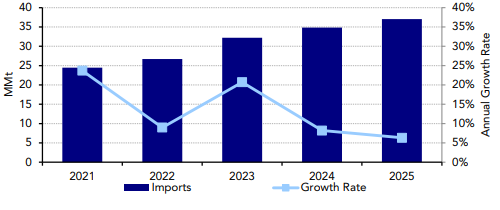

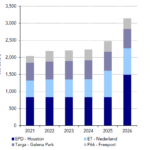

China LPG Import Forecast and Growth Rate

Chinese LPG imports fell to 2.1 MMt in February 2024 from 2.6 MMt in January. The rise in imports in January was due to expectations of higher demand for downstream petrochemical products during the Lunar New Year and the fall in February was likely due to warmer weather in East and South China, depressing some residential and commercial demand. Conversely, preliminary shiptracking data indicates that imports rose in March 2024 to around 2.8 MMt. Additionally, PDH operating rates increased to 65% in March compared to 60% in January 2024.

However, operating rates dipped to 51% at the end of first week in April 2024 on maintenance at two PDH units while another two were shut down due to malfunctions. Conversely, three PDH units are expected to resume work postmaintenance and imports are forecast to decline only slightly to 2.6 MMt in April 2024. For 2024, imports are forecast to increase by 8% to roughly 35 MMt and 6% to 37 MMt in 2025. Persistent negativeto-low PDH margins continue to be a nagging bearish factor and are forecast to keep PDH demand growth to a minimum in 1H 2024.

.

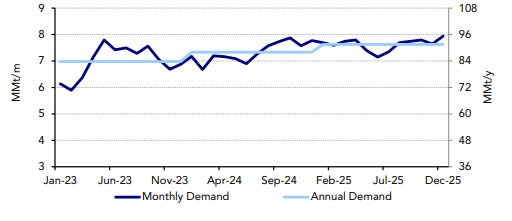

China LPG Demand Forecast

LPG demand in China is forecast to increase from 83.7 MMt in 2023 to 88 MMt in 2024 and continue rising in 2025 to 91.5 MMt with much of the growth driven by expansions in the PDH sector. The demand forecast for the shoulder months of April to September 2024 is around 43.7 MMt. Demand was 44.7 MMt over the same period in 2023. The recent rise in prices in the US propane forward curve due to higher crude prices and inventory withdrawals only adds to bearish sentiment in the petrochemical China LPG Import Forecast and Growth Rate China LPG Demand Forecast Percent of China VLGC/LGC Imports by Source sector in China in the near term. End-user demand for downstream petrochemical products needs to increase for LPG demand from China to be higher than currently expected.

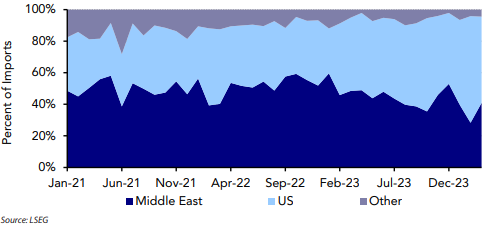

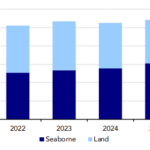

The bottom graph shows the percent of VLGC/LGC Chinese LPG imports by source. The percentage of US supply as a percent of total imports rose from an average of 40% in 2022 to 50% in 2023. Through 1Q 2024, the percentage has increased to 60%.

Percent of China VLGC/LGC Imports by Source

LPG Opinions

Subscribe to Poten’s LPG Market Outlook

Strong business decisions require sound industry expertise and analysis. For more information, or to subscribe to Poten’s LPG Market Outlook, contact [email protected]

Also available from Poten Business Intelligence:

Monthly LPG & Shipping Market Analysis

Poten’s LPG in World Markets

Insight on LPG markets, projects and the industry

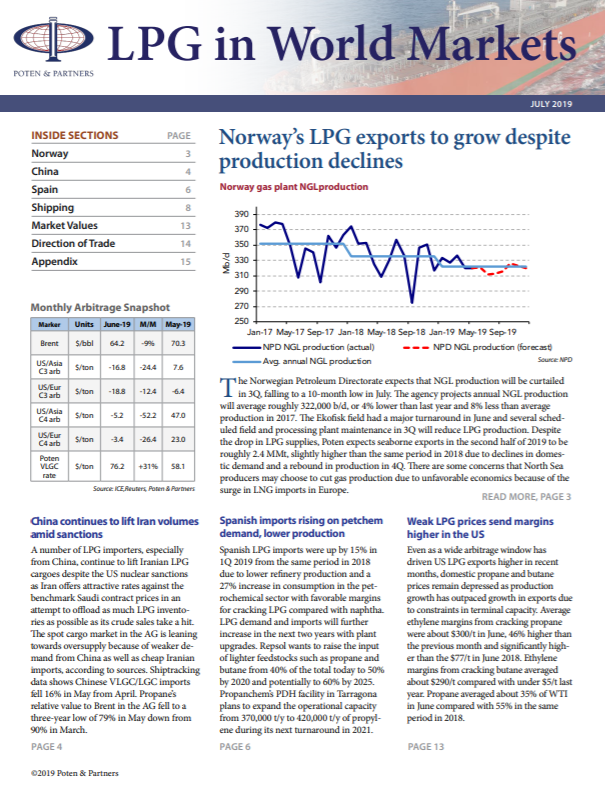

In-depth monthly analysis of global LPG markets. Key features include analysis of LPG supply-demand, petrochemical feed costs, updates on spot fixtures, shipping rates, arbitrage opportunities, import/export and trade flow data for major markets.