- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LNG Finance in World Markets

Insight on financing across the LNG value chain

→ Market Insights → LNG Top Lenders → Learn More → Subscribe

Poten’s LNG Finance in World Markets provides information and insight on how LNG projects, shipping and infrastructure are financed.

Detailed analysis of industry developments and trends

Liquefaction finance intelligence in-depth

LNG shipping investment activity

Infrastructure funding and development

Banking sector and regulatory updates

Corporate finance and activity including equities and M&As

Critical LNG finance analysis for a changing market

Coverage across the value chain

Clients receive focused, unique data and analysis on the types of financing used for liquefaction projects, regasification, LNG-to-power and LNG shipping. This information allows clients to understand what approaches have worked for other projects and to develop successful strategies.

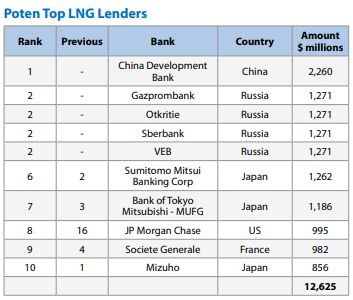

Insight on lending and annual rankings

LNG Finance in World Markets delivers unique data on all sources of funding, including commercial banks, export credit agencies, development banks, bond and share offers. Poten also provides an annual ranking of banks and other financing institutions lending to the LNG sector.

Analysis of projects

LNG Finance in World Markets provides a detailed analysis of a full range of LNG projects to determine how their characteristics affect their ability to raise funds. Coverage includes project finance, export credit agency lending and insurance cover, corporate equity funding and M&A transactions.

Contracts and commercial structures

Poten is the global leader in information on LNG contract terms, providing clients with unprecedented clarity on structuring, pricing and other critical elements of long-and short-term transactions. These long-term supply contracts are critical to securing project finance for new projects.

The extensive data and analysis provided by LNG Finance in World Markets give industry participants the insight they need to understand LNG financing and to implement effective financing strategies across the LNG value chain.

This service is a valuable tool for:

- Project Developers

- End Users

- Aggregators & traders

- Equity Investors

- Strategic Planners

- EPC firms and manufacturers

- Financial institutions

- Service providers to the LNG industry

Take a Closer Look at LNG Finance in

World Markets

LNG industry participants rely on Poten’s long-term forecasts and market analysis to make better strategic decisions. To learn more or activate your subscription, connect with us today: [email protected]

Get to Know Poten’s LNG Business Intelligence Services

Actionable short term market intelligence

- Monthly country-level forecasts

- Global arbitrage analysis

- Detailed data on future trade flows

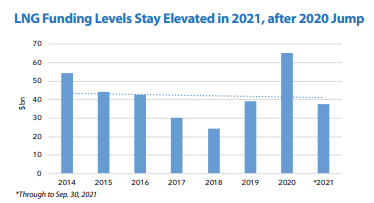

Analysis of LNG finance across the value chain

- Annual ranking of LNG lenders

- Detailed analysis of project lending

- Intelligence on project finance structure

- Insight on lending to the shipping sector

A 10-year price, supply and demand forecast

- 10-year projections

- Bottom-up demand forecasts

- LNG imports and exports

- Special focus on shipping

Insight on LNG markets, projects and the industry

- Commercial and technical details of global projects across the value chain

- Detailed coverage of spot markets with data and analysis on market fundamentals, price levels and trade flows

- Shipping activity and technology developments