- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LNG Finance in World Markets Featured Article

Record Liquefaction Funding Gets US Boost

This current feature was extracted from the latest edition of Poten’s LNG Finance in World Markets, a monthly service published on January 5, 2024.

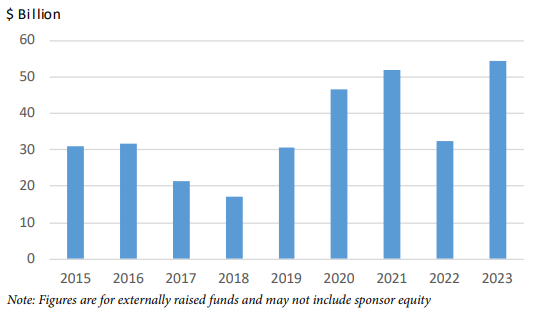

Liquefaction financing jumped to a new record of $54 billion in 2023, propelled mostly by three multi-billion-dollar US transactions. The figures were boosted by the completion of project finance deals for NextDecade’s Rio Grande LNG Phase 1, Sempra’s Port Arthur Phase 1 and Venture Global’s Plaquemines Phase 2. Adding to the total were a slew of large bond offers that were mostly used to refinance bank debt for US projects.

US liquefaction funding in 2023 was almost double the next highest yearly US total of around $27 billion seen in 2019. There was very little liquefaction fundraising outside the US, except in Australia for EIG’s LNG unit, MidOcean Energy, which sought to purchase Origin Energy’s integrated gas business – although this deal subsequently fell through.

At $54 billion, liquefaction funding in 2023 edged above the next highest year – the $52 billion seen in 2021. That year’s strong showing came in part from a $12.5 billion QatarEnergy bond issue and a €9.5 billion ($10.75 billion) project finance deal for the Arctic LNG 2 project in Russia, along with a steady stream of US project refinancings.

In 3Q 2023, developer NextDecade closed the largest ever single-phase financing for a US project when it secured $11.6 billion in bank debt and a smaller, $700 million bond offer for its 17.5-MMt/y Rio Grande LNG project.

US LNG bond issuance jumps to highest level

Bond issuance by US LNG export projects jumped to a record level of $12.6 billion in 2023. The only two liquefaction deals transacted in 4Q 2023 were two large bond issues for Venture Global that took its 2023 total issuance of paper, along with two offerings in May, to $9.5 billion.

These Venture Global bond offerings combined to make the largest US dollar high yield bond issuance by one entity in a single year since 2015. Venture Global unit, the Calcasieu Pass LNG project also priced bonds in January 2023, adding another $1 billion to the company’s total. Like many other US liquefaction developers, the company uses bonds to refinance bank debt once project construction is advanced or completed. As well as Venture Global and Rio Grande LNG, bonds were also issued in 2023 by Cheniere Energy Partners.

Bond issuance by the US liquefaction sector had fallen to a paltry $919 million in 2022. That year higher volatility put off both global bond issuers and investors who struggled to deal with inflation risk, central bank tightening cycles, recession and political upheaval.

External equity raising up sharply

Raising of external equity for US liquefaction projects was up sharply in 2023, hitting around $9 billion. The amount of third-party equity being raised for US projects has recently risen, as sponsors have tried to lower their risk exposure to projects or in the case of Sempra (the lead developer of the Cameron LNG and Port Arthur LNG projects) to maintain investment grade credit ratings at a corporate level. They have also used equity stakes as a lure to sell more of their production.

Equity is included in the liquefaction financing figures if it is externally raised. Equity may or may not include fund-raising by the original sponsor – that can appear under issues of shares, bonds, bank loans, etc.

For example, Plaquemines Phase 1 secured $13.2 billion in project finance loans last year, but only about $9 billion of this is debt, with the remainder representing the funding raised for the holding company. In this respect it is acting like equity. Project financings have a debt and equity component and usually the ratio is around 65-75% debt to 30-35% equity.

Liquefaction Funding by Year

Buoyant 2024 expected for liquefaction funding

Much of the financing activity witnessed in 2023 is expected to focus on North America again. A handful of LNG export projects had been targeting 2023 for final investment decisions (FIDs) and they are likely to get the greenlight in 2024. They include Delfin FLNG1, Del- fin FLNG2, Cedar LNG, Mexico Pacific Limited’s Saguaro LNG and Lake Charles LNG. Including these projects, there are a total of 22 permitted North American LNG export projects with a combined capacity of 186.6 MMt/y which are competing to sign long-term contracts and secure financing.

Not all of these 22 projects will get built because not all of them will sign up enough customers to unlock financing. Some of the smaller, greenfield players will struggle and could be leapfrogged in the race to FID by larger incumbents doing expansions or further projects who may or may not have secured all their permits. They include Rio Grande Train 4, Port Arthur Phase 2, Cameron Train 4, Venture Global’s CP2 LNG and Cheniere Energy’s Stage 5 expansion.

In Australia more liquefaction project debt refinancing, and further funding of mergers and acquisitions remains a possibility. While the Origin Energy takeover by EIG-Brookfield was rejected, Australia’s Woodside and Santos are mulling a merger that would create an LNG powerhouse.

The $10 billion Papua LNG export project in Papua New Guinea is seeking funding and is in discussions with export credit agencies to develop the term sheet which will be sent to banks. Nigeria LNG is looking at adding $1 billion to the $3 billion of corporate loans it raised for its 7.6-MMt/y Train 7 project in 2020 and the Nigeria FLNG project fronted by a local developer is also seeking funds.

Funding is also being sought for a second FLNG unit for Mozambique, Coral Norte FLNG (see p. 9). Mozambique LNG’s sponsors are expecting to resume construction on their Area 1 project and when they do, they will start drawing again on the funding they secured from banks in 2020.

In Russia, Arctic LNG 2’s project partners are also looking to tap the €9.45-billion external funding package provided by Chinese and Russian banks, but US sanctions have pushed Novatek to send force majeure notices to customers and could threaten the project.

Meanwhile, QatarEnergy and its partners are not expected to use project finance for the North Field East expansion, that will take Qatari LNG production capacity to 110 MMt/y from 77 MMt/y.

Subscribe to Poten’s LNG Finance in World Markets

When it comes to actionable analysis across the LNG value chain, Poten’s LNG Finance in World Markets is the most trusted source for intelligence on project finance structure, lending in the LNG shipping sector and analysis. To activate your subscription or learn more, connect with us today: [email protected]

Get to Know Poten’s LNG Business Intelligence Services

Actionable short term market intelligence

- Monthly country-level forecasts

- Global arbitrage analysis

- Detailed data on future trade flows

Analysis of LNG finance across the value chain

- Annual ranking of LNG lenders

- Detailed analysis of project lending

- Intelligence on project finance structure

- Insight on lending to the shipping sector

A 10-year price, supply and demand forecast

- 10-year projections

- Bottom-up demand forecasts

- LNG imports and exports

- Special focus on shipping

Insight on LNG markets, projects and the industry

- Commercial and technical details of global projects across the value chain

- Detailed coverage of spot markets with data and analysis on market fundamentals, price levels and trade flows

- Shipping activity and technology developments