Breaking The Price Cap

Are owners leaving the Russian crude export trade?

When the G7 introduced the crude oil price cap in December 2022, the idea was to keep the oil flowing, but at the same time limiting the oil export revenues for Russia as a punishment for their invasion of Ukraine. The price cap was set at $60/barrel, which is the maximum sales price at which marine service providers (owners, charterers, insurers, brokers, etc.) from G7 and EU countries can be involved in the Russian crude oil trade. Since the price cap was set, oil prices in the Russian Far East have exceeded the $60/barrel almost continuously. As a result, western owners have mostly avoided this trade.

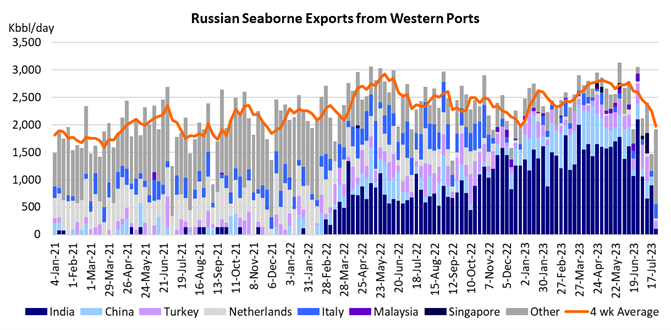

The situation in Russia’s Western ports has been different. The price of Urals, the benchmark Russian crude mostly shipped from the Baltic and the Black Sea remained mostly below the price cap, with the exception of a few weeks in April 2023.

As a result, Western shipping companies, in particular some of the larger private Greek Aframax and Suezmax owners have continued to move Russian barrels. However, the price of Urals breached $60/barrel again on July 7, 2023. Since then, prices have continued to increase, and the price of Urals is now within touching distance of $70/barrel.

Does this mean that Western owners are abandoning this (premium) trade and, if so, will this reduction in vessel availability compromise Russian export volumes? In today’s Weekly Tanker Opinion, we will try to find some answers to these questions.

To read the full article, click please fill out the form.