VLCC’s at a Crossroad

In recent years, the oil markets seem to be conspiring against the Very Large Crude Carriers (VLCCs). VLCCs have traditionally been the bellwether of the tanker market. The largest crude oil carrying ships were usually a leading indicator of where the markets were heading. This changed during the pandemic.

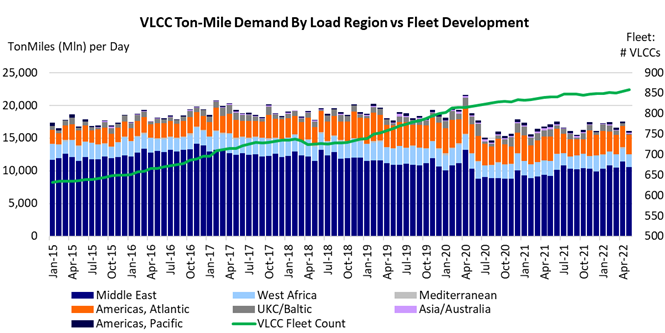

The massive OPEC production cut led to a significant reduction in long-haul VLCC demand and created significant overcapacity in this segment. The sanctions on Iran and Venezuela, both important VLCC markets, are also hurting this segment more than others, with the “rogue fleet” eating into their employment opportunities.

When the global economy started to recover from the pandemic and OPEC was gradually restoring production, things started to look up. Then came the Russian invasion of Ukraine and multiple Covid lockdowns in China, both of which dampened long-haul crude oil demand. Are these just temporary setbacks for the VLCCs or are there structural challenges facing the VLCC segment long-term?

To read the full article, please fill out the form.