LPG Market Outlook: Higher Prices to Lower Near-Term Chinese Demand

This current feature was extracted from the latest edition of Poten’s LPG Market Outlook, a monthly service published on April 12, 2024.

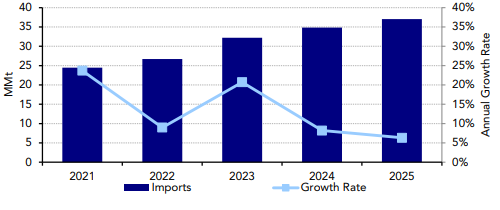

Chinese imports rebounded in March 2024 from February lows, but bearish sentiment shrouds the future of LPG demand in the near-term. Not only are petrochemical players continuing to struggle with weak margins, but US prices have risen in recent weeks due to higher oil prices. Oil prices are unlikely to fall in the near term and US prices are likely to remain elevated as a result, keeping demand growth to a minimum.

Chinese LPG imports fell to 2.1 MMt in February 2024 from 2.6 MMt in January. The rise in imports in January was due to expectations of higher demand for downstream petrochemical products during the Lunar New Year and the fall in February was likely due to warmer weather in East and South China, depressing some residential and commercial demand. Conversely, preliminary shiptracking data indicates that imports rose in March 2024 to around 2.8 MMt. Additionally, PDH operating rates increased to 65% in March compared to 60% in January 2024.To read the full article, please click here.