LNG in World Markets: Spot Charter Rates Stay on the Uptrend

This current feature was extracted from the latest edition of Poten’s LNG in World Markets Mid-Month, a monthly service published on September 14, 2023.

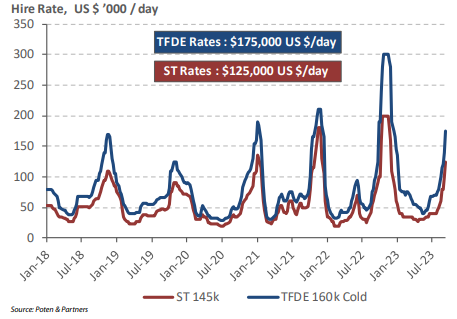

Spot charter rates ranged from $120,000/d to $210,000/d depending on vessel type, with Pacific and Atlantic Basin rates at parity, in the week ending Sep. 15 (see Table and Chart on the next page).

Term one-year charter rates for M-type electronically controlled gas injection (MEGI) and X-DF vessels were assessed at $120,000/d in the week ending Sep. 15, down from $125,000/d two weeks ago. Tri-fuel diesel electric (TFDE) and dual-fuel diesel electric (DFDE) rates were assessed at $95,000/d, down from $100,000/d two weeks earlier, while those for steam turbine vessels were assessed at $50,000/d, unchanged from two weeks ago.

Spot charter rates have been propped up as fixing focus shifts to the northern hemisphere peak-demand period. Spot charter enquiries are now mostly for October and early November laycans. There is spot freight interest and some fixing in both the Pacific and Atlantic Basins. India’s Petronet is seeking a spot charter for a Ras Laffan loading in mid-October via tender, sources said.

To read the full article, click here.