- About Us

- What We Do

- Where We Are

- Join Us

- What’s New

- Poten Portal

- Contact Us

LNG Finance in World Markets Featured Article

US Projects Drive Liquefaction Finance to Record Level

This current feature was extracted from the latest edition of Poten’s LNG Finance in World Markets, a monthly service published on October 22, 2025.

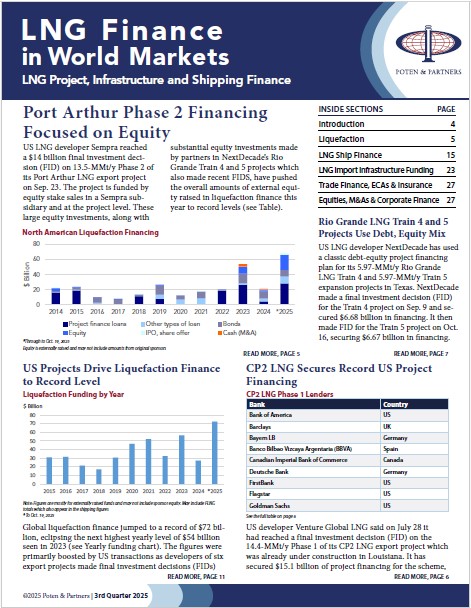

Liquefaction Funding by Year

Global liquefaction finance jumped to a record of $72 billion, eclipsing the next highest yearly level of $54 billion seen in 2023 (see Yearly funding chart). The figures were primarily boosted by US transactions as developers of six export projects made final investment decisions (FIDs) and secured financing. Six US FIDs in one year is unprecedented– the highest number before this year was three US projects. The liquefaction finance tally could continue to climb in the final quarter of this year as a few more projects – also in the US – appear to be nearing FID.

Most of this year’s financing was focused on the third quarter (see Quarterly funding chart), as three US projects reached FIDs and obtained funding, with one project (Rio Grande LNG Train 5) then done early in the fourth quarter:

- Venture Global’s CP2 LNG Phase 1 used a project finance structure and bank loans to cover debt and initial equity commitments.

- Next Decade’s Rio Grande LNG made FID on two projects, Train 4 in 3Q 2025 and Train 5 in 4Q 2025. They both used project finance, with loans from banks and institutional investors deployed for equity as well as debt, although also brought in third party equity providers.

- Sempra’s Port Arthur LNG Phase 2’s funding was mostly secured by equity stake sales to third parties (see Liquefaction section).

These four FIDs followed another two in the US in 2Q 2025:

- Woodside made FID on Louisiana LNG with partner Stonepeak using a back-leveraged project financing (see LNG Finance, Jul ‘25).

- The largest US LNG producer, Cheniere Energy, made FID in June on Corpus-Christi Midscale2.9-MMt/y Trains 8 and 9 expansion project in Texas, but with sufficient cash flows from operations, and the project’s smaller size, it did not need to seek external finance.

The varied mix of financing types used this year by US projects is unusual (see Liquefaction Financing Review table). Over the last several years US projects have tended to use classic non-recourse project finance, and although debt/equity levels have varied across them, their financings have been broadly similar, with a few outliers; Golden Pass LNG developed by ExxonMobil and Qatar Energy did not need external finance.

Outside the US there has also been some financing associated with an FID in Argentina for the Southern Energy FLNG export project which will use FLNG conversion specialist Golar LNG’s 2.45-MMt/y Hilli and MK II FLNG units. The project’s developers include Argentina state owned YPF, Pampa Energy and Harbour Energy as well as Golar. Argentina is seeking to boost production at its Vaca Muerta shale gas reserves to become an LNG exporter through a phased development plan. In October, YPF and Italy’s Eni signed a final technical project description agreement, which is viewed as a milestone toward a reaching FID for their joint 12-MMt/y Argentina LNG export project (see LNG Finance Jul ’25). YPF said in October that Argentina’s plan to double Vaca Muerta production will require investment of $15 billion up stream and $25 billion for infrastructure. YPF is hoping to reach FID in 2Q 2026 on Argentina LNG, which could ultimately require total capital expenditure of $50 billion. YPF is understood to be seeking project finance loans of around $20 billion for the project.

Golar did two bond offers in 3Q 2025, some of which will be applied to fund its fourth FLNG unit (see Shipping section). Finance was also secured by Nigeria LNG on a corporate basis, and Canadian projects Cedar LNG, which made FID last year, and the pre-FID Ksi Lisims.

Some of the other large refinancings transacted this year were US-focused, with Venture Global using bonds to refinance some of the debt for Plaquemines LNG, its second project. Cheniere Energy Partners also refinanced the 2026 notes held by its Sabine Pass Liquefaction subsidiary to extend their maturities and Freeport LNG also refinanced some debt using bonds (see North American Liquefaction Project Funding chart).

Other refinancings were done by Golar LNG and Israel’s Ratio Energies. Liquefaction operation/project refinancings so far this year total almost $13 billion with over$10.5 billion of these centered in the US (see Liquefaction Financing Review Table).

Financing levels could continue to climb

In the US, LNG financing levels are expected to continue to climb. Others, such as Delfin FLNG1, Energy Transfer’s Lake Charles and, and Ksi Lisims in Canada, are on the path to FID but it may take until 2026 for them to realize this objective.

In April MidOcean signed a heads of agreement to fund up to 30% of the 16.5-MMt/y Lake Charles project, which would entitle it to 30% of its production of around 5MMt/y. MidOcean is understood to be looking to raise about $5 billion for the project, targeting a 60/40 debt/equity ratio.

Commonwealth LNG also appeared to be nearing FID, but it could be slowed by a petition against it by the Sierra Club, Louisiana Bucket Brigade and Turtle Island Restoration Network. On Oct. 10 the 38th Judicial District Court in Cameron Parish, Louisiana, found that the Louisiana Department of Energy and Natural Resources’ Office of Coastal Management (OCM) failed to consider the facility’s impact on climate-related change to the coastal zone and environmental justice issues. It has remanded the case to the OCM and vacated its coastal use permit (CUP) until the OCM has considered these issues and makes a finding that the benefits of this project outweigh the costs to the community.

Outside the US, the 3.6-MMt/y Eni-led Coral Norte floating LNG (FLNG) project in Mozambique made FID in October but is expecting to finalize its project financing next year – sometimes financing can post-date FID. Coral Norte is seeking commercial bank loans after export credit agencies advanced the deal with sponsors and financial advisor, Japan’s MUFG.

The $15 billion TotalEnergies-led Papua LNG project in Papua New Guinea has approached ECAs and commercial banks to secure funding. Other export projects engaging with banks include Oman LNG for a 3.8-MMt/y fourth train expansion at its three-train, 11.4-MMt/y Qalhat LNG export facility; Malaysia’s Petronas for around$1 billion in project finance loans for its third FLNG facility; and Malaysia’s Genting Berhad for a $1 billion FLNG project in Indonesia’s West Papua province. Inpex is targeting a 2027 FID for $21 billion Abadi LNG in Indonesia and has held meetings with ECAs and banks to discuss a debt package of around $13 billion.

Subscribe to Poten’s LNG Finance in World Markets

When it comes to actionable analysis across the LNG value chain, Poten’s LNG Finance in World Markets is the most trusted source for intelligence on project finance structure, lending in the LNG shipping sector and analysis. To activate your subscription or learn more, connect with us today: [email protected]

Get to Know Poten’s LNG Business Intelligence Services

Actionable short term market intelligence

- Monthly country-level forecasts

- Global arbitrage analysis

- Detailed data on future trade flows

Analysis of LNG finance across the value chain

- Annual ranking of LNG lenders

- Detailed analysis of project lending

- Intelligence on project finance structure

- Insight on lending to the shipping sector

A 10-year price, supply and demand forecast

- 10-year projections

- Bottom-up demand forecasts

- LNG imports and exports

- Special focus on shipping

Insight on LNG markets, projects and the industry

- Commercial and technical details of global projects across the value chain

- Detailed coverage of spot markets with data and analysis on market fundamentals, price levels and trade flows

- Shipping activity and technology developments